When purchasing a home in Colorado, buyers must budget for various closing costs in addition to their down payment. Although some closing fees are split 50/50 between the buyers and sellers other costs are solely the buyer’s responsibility. As a licensed mortgage loan originator, I’ll review below the typical closing fees paid by Colorado home buyers.

Title Fees

Title insurance protects homeowners if issues emerge with the legal title on a property. It is required by most mortgage lenders in Colorado. Common title charges buyers pay include:

– Title Search – The cost to research into the legal ownership and confirmation of liens on the subject property. The cost is usually around $175 and may be bundled with the title premium.

– Title Insurance Premium – The amount for the lender’s title insurance policy and normally calculated at 0.1-0.2% of the home’s purchase price. If you choose to pay for an owner’s policy it will run you about another 0.25% of the purchase price. Although most buyers don’t purchase the owner’s policy title agents say it is a good decision to have it.

– Title Closing – The title company’s state licensed closing coordinates with the lender to completes the buyer’s closing and transfer title and ownership. The price usually ranges from $450 to $1,000 depending on the purchase contract price.

Here’s an example of Title insurance fees for a home purchase in Littleton, CO for $549,000.

Title Fees: $525.00 – Title Insurance ALTA Loan Policy

(includes applicable endorsements and current tax certificate)

Closing Fees: $450.00 – Bundled Residential Loan Closing Fee

$190.00 – Bundled Real Estate Closing Fee

$54.90 – Transfer Tax 0.0100 percent

Total: $1,219.90

The lender must adhere to strict regulations that require a perfect title conveyance, or they will not lend money on the property. This protects all parties.

Government Recording Charges

When property ownership legally transfers, various government entities require notice. The associated recording fees include:

– Deed Recording Fee – From $33 and up to file the new deed with the local county clerk’s office.

– Mortgage Recording Fee – Approximately $30 to record the mortgage documents.

– Releases – Minimal $15 fees to show paid-off mortgages or liens released by sellers.

Home Warranty

Home warranty policies provide repairs and parts replacement for home systems and appliances that break down by a certified professional. A one-year policy often costs $500 to $700 in Colorado. Buyers sometimes pay this fee.

Home Inspection Reports

Most buyers hire inspectors to assess the physical condition of properties before closing. Average costs fall between $300 to $500 depending on house size and scope of inspection. Any repairs are typically negotiated with the sellers.

Appraisal Reports

Most buyers pay this fee to the lender to schedule an inspection by a local licensed appraiser to determine the value of the property prior to closing. The cost usually ranges from $450 for a condo under $300,000 up to $1,500 for a multi-million dollar home depending on the home’s square footage and inspection scope.

For investment properties a supplemental market rental survey is usually ordered as well. Supplemental reports tend to add another $150-$200 for the total cost. If the value comes in below the contract price the purchase price is either renegotiated or the transaction is cancelled by the buyer.

Loan Fees – Banks, mortgage lenders, and regional mortgage brokers usually charge a fee(s) to buyers to secure financing. Homebuyers who intend to own the property for many years normally choose to pay higher loan fees to get a low interest rate versus accepting a high interest rate in order to pay low or no fees. Normal loan fees buyers pay include:

– Underwriting – A fee paid at closing to cover the verification of income, employment, liquid assets, debts, credit history, housing history, and title insurance by the lender’s staff to confirm what is on the loan application is accurate.

Underwriting cost: $850 to $1,595 – Lender’s fee, not the broker (higher limit is for non-traditional loans)

– Processing – The is a fee paid at closing to have the loan processed and prepared with the required documentation to submit to the underwriting department.

Loan Processor cost: $695 to $895 – Sometimes bundled with origination fee; or none at all (with me)

– Loan Origination – The cost to originate a loan that is disclosed as a percentage of the loan amount. A 1% origination fee on a $549,000 home is $5,490. It’s mostly higher if the loan is non-QM or an investment property.

Expert Tip: While almost every lender is able to offer a no origination fee loan there is a cost for doing so. That cost is the interest rate you’re being offered with no loan fees is higher than the par rate and includes their origination fee. It’s best to compare rates with no origination fees, 1-point cost, and 2-point cost.

Let’s not forget you may be able to negotiate with the seller to credit you with 1-percent (or $10K) towards closing costs which covers the loan origination fee or for a no cost loan, it covers your other closing expenses.

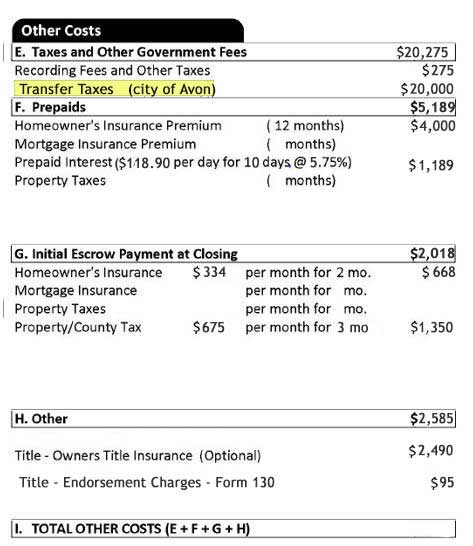

Here’s an actual document example on a $1 million home.

Prepaid Items

Closing statements also include a few prepaid items, such as:

– Homeowner’s Insurance Premium – Varies from insurance provider

– Property Taxes – Prorated for the portion left in the year

– HOA Fees – If part of an association and all condos.

In comparison to other states, homeowners insurance is on the low side. Colorado’s property taxes are considered very low for homeowners. Here’s some recent property tax legislation passed by the Colorado General Assembly that reduces the property tax even more.

It’s not uncommon for the buyer to pay a $100-$350 fee directly to a specific HOA to complete the lender’s 3-4 page condo questionnaire This is usually paid outside of closing and should be included in your budget when looking to buy a condo, no matter if it’s warrantable or a non-warrantable condo.

Transfer Taxes

Several mountain communities and resort areas in Colorado impose a tax when properties exchange ownership. Popular destinations with transfer taxes include:

– Denver City & County: 0.02% ($200 on a $1,000,000 property)

– Pitkin County: 1.5% or $15,000

– San Miguel County: 2% or $20,000

– Winter Park (Grand County): 1% or $10,000

– Avon (Eagle County): 2% or $20,000

– Beaver Creek (Eagle County): 2.375% or $23,750

In total, around 15 counties and municipalities in Colorado charge a type of transfer tax ranging from 0.01% to 2% of the purchase price. For a $500,000 home purchase, this equals $50 to $10,000 depending on the specific location within the state. Cities like Aspen and Avon tend to be on the higher end around 1-1.5% while more affordable areas may charge just a 0.01% documentary fee.

It’s important for home buyers to research the transfer taxes in the county and city where they are looking to purchase to accurately calculate this closing cost fee. Their real estate agent or title company should also explain the local transfer taxes at play on any property sale.

Closing costs add up quickly for home buyers in Colorado. Title fees, taxes, legal charges and more lead to thousands in fees by closing. This is on top of down payments and loan costs.

To budget accurately, connect with professionals early on. A closing agent of Land Guaranty Title Company explained:

“Working with an experienced real estate agent, mortgage originator and title company from the initial home search through closing helps buyers know what to expect when they go to closing. We’ve handled thousands of transactions across different counties. I recommend buyers ask about all costs upfront so they can plan accordingly with their lender and make prudent offers.”

In total, allow 2-5% of the purchase price for closing fees in Colorado, depending on location and price point. Converting estimates to dollar amounts makes budgeting easier. Also build in buffers for unforeseen charges. Understanding all costs now will lead to a smoother process once under contract.