Loans to Buy or Refinance a Condo

High-rises, Condotels, Attached Residences, and Townhomes

Considering a Condo Mortgage in Colorado?

Review our popular loan programs to finance a condominium

Which Condo Loans are available?

People interested in buying a condo may experience a few more conditions than purchasing a single family detached home with a mortgage. There are additional requirements for Colorado condo financing transactions which entail a review of a completed questionnaire by the homeowners association before financing is approved.

If the condo project is FHA approved, you can purchase it as a primary residence with a 3½ percent down-payment*. We can help tell you if a building is FHA-approved so you can shop with confidence.

If the condo community is Fannie Mae approved, the minimum condo down payments are:

– Primary Residences: 3%

– Second Homes: 10%

– Investment Property: 15%

Mortgage Rates for Condos in Colorado

The mortgage interest rate for a Colorado Condo is determined by many different factors which include:

– Your middle credit score from the lender's tri-merge credit report

– Monthly debt-to-income ratios

– Loan types; adjustable or fixed-rate

– Your down payment amount (or equity for a refinance)

– Condo community warrantability

If the project is not Fannie Mae or FHA approved, you may be eligible for non-warrantable condo financing which is discussed below.

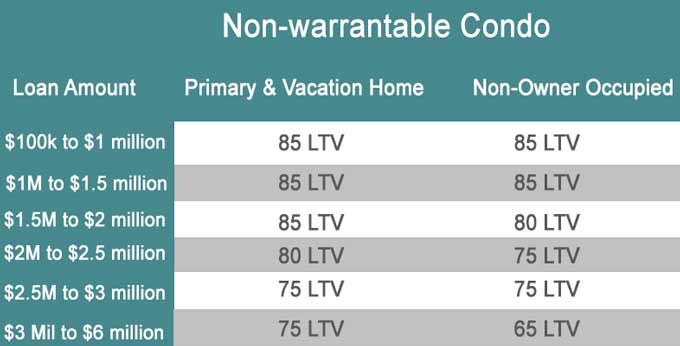

Non-Warrantable Condo Loans

Getting a mortgage for a non-warrantable condo can be a challenge. However, it's one we've closed easily with the right lender.

Non-Warrantable Condo issues for buyers

Were you declined by the bank or lender due to:

‐ Condo association didn't allocate 10% of their revenue to fund reserves?

‐ them requiring a 25- to 35-percent down payment for a primary residence?

‐ the project is still under construction

‐ the master condo insurance policy has co-insurance?

‐ a condition that 51-percent be owner-occupied or second homes?

The above issues are not a deal breaker for us. We are able to close condo loans that have these non-warrantable issues routinely.

Here are some deal breakers – a condo building in need of structural repairs or pending litigation with the HOA

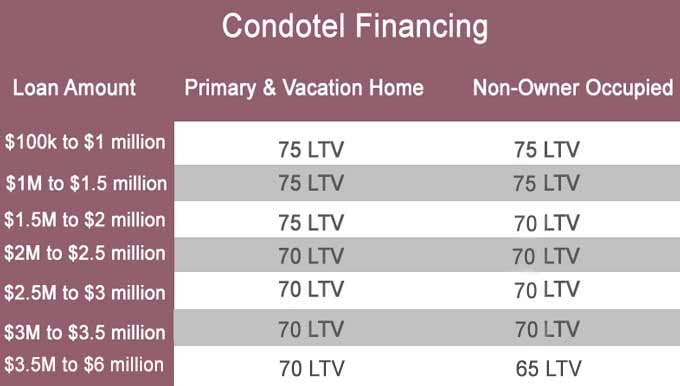

Need Condotel Financing?

Learn how condotel mortgages work in Downtown Denver, Aspen, Snowmass Village, Steamboat Springs, Telluride, and Vail.

A Condotel is a condominium that is typically within a ski resort area or luxury downtown building that operates like a hotel where owners can rent out their units when they are not occupying it to produce additional income. Many people finance a vacation home condo for winter getaways or simply rent it out to tourists for short term rental income the whole year.

We have condotel programs that allow up to 75% financing on condo-tels priced up to $2.5 million as a primary or second home. Rates improve when you have 30-percent down (70 LTV) financing.

Condotel purchase loan down payments are identical for a primary residence, vacation home or exclusively used as a rental property. Refinance transactions have lower LTVs than if buying.

Condo-tel Property Requirements:

Must have a minimum of 500 sq. feet (no exceptions)

Must have a full kitchen and at least 1 bedroom (no studio units or two units sharing an entry door)

Must be available to be lived in year round without HOA limits

Fast Track the Process

The mortgage process for this non-QM loan includes an analysis of the HOA's financials by the lender. Knowing why the HOA or realtor considers the unit to be non-warrantable will help expedite the process.

- ● Gather copies of 2 months of account statements for all assets being used - savings, retirement, investment brokerage, money market, CDs, etc. .pdf format statements are preferred.

- ● Gather copies of tax returns for the last two years and most recent paystub or YTD P&L if self-employed.

- ● Prequalify with a licensed mortgage originator to confirm if you qualify.

Still have questions? Check these answers

-

What are some reasons a lender will not lend on a Non-warrantable Condo?

If any of the project's buildings or units have structural damage or if the HOA is in pending litigation.

-

What are reasons a lender will not lend on a Condotel?

One reason is the HOA doesn't have sufficient cash reserves. Others are some units are owned as timeshares, the unit cannot be rented during certain days of the year by the owner, it's less than 500 square feet, or lacks a dedicated kitchen area or separate bedroom.

-

What reasons will a lender not lend on a FHA or Fannie-mae approved condo?

When the unit falls into the category of being non-warrantable which includes one person or entity owning more than 10-percent of the units, the builder/developer hasn't transferred ownership, or the majority of units are non-owner occupied. The condo project is likely on the denial list.

Areas Served

We serve borrowers throughout the state of Colorado which includes these cities:

- Boulder

- Denver

- Colorado Springs

- Fort Collins

- Union Station

- LoDo

- Highlands Ranch

- Englewood

- Aspen

- Avon

- Snowmass Village

- Vail

Disclosure: Minimum loan amount is $150,000 for residential. Loan programs are subject to change per lender at any time until the loan is approved and the rate is locked. Borrowers must be approved by underwriting. Not all applicants will qualify.